Depositing funds into your Pocket Option account opens the door to a wide range of trading opportunities across global financial markets. Whether you’re an experienced trader or a beginner, knowing how to deposit funds quickly and securely ensures smooth transactions and allows you to make the most of the platform’s features.

This guide offers a simple, step-by-step process to help you deposit funds with ease and start your trading journey confidently.

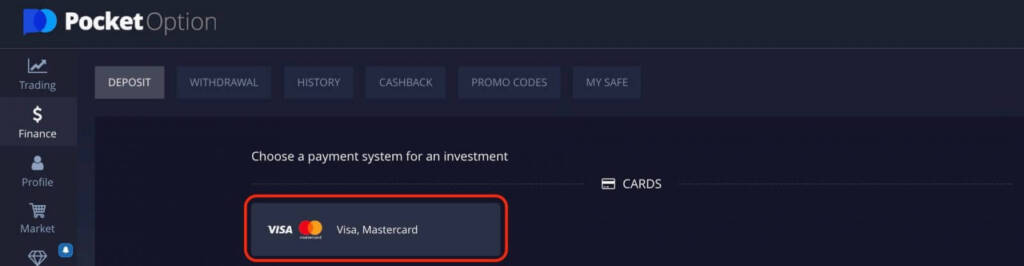

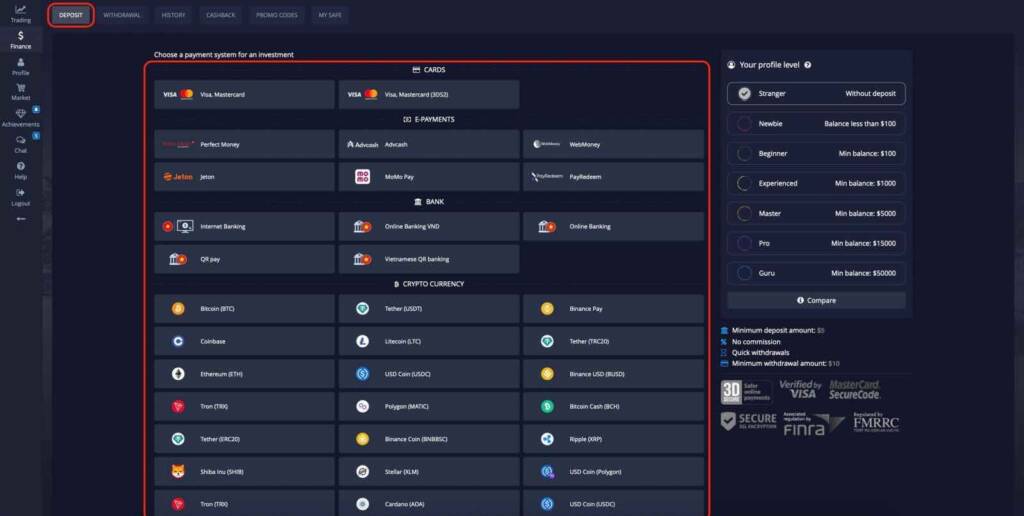

Pocket Option Deposit Payment Methods

Pocket Option provides users with various payment methods to conveniently deposit on the platform. The availability of specific payment methods may vary depending on your location. Here are some of the most popular payment methods on Pocket Option are:

Credit or Debit card

You can use your Visa or Mastercard to deposit money on Pocket Option. This is one of the fastest and easiest ways to fund your account. The minimum deposit amount is $5 and the maximum is $10,000 per transaction.

E-Payments (Electronic Payment Systems)

Pocket Option supports popular e-payment systems such as Advcash, WebMoney, Perfect Money, and others. These systems offer secure and fast transactions, making them a preferred choice for many traders. The minimum deposit amount is $5.

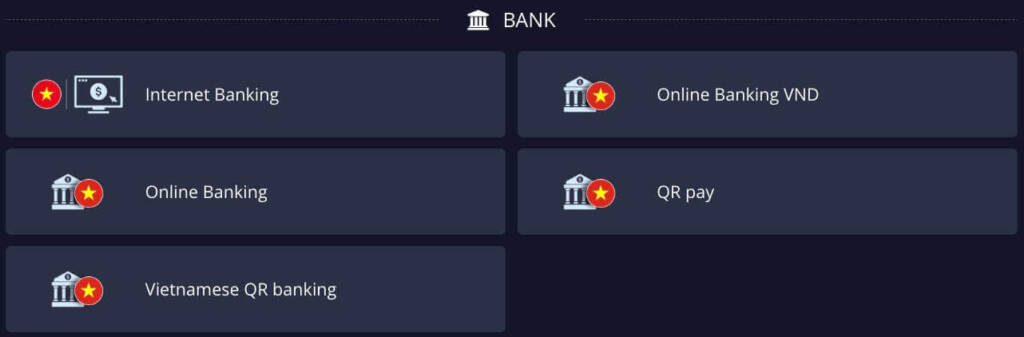

Bank Transfers

Pocket Option provides traders with a convenient and secure option to deposit funds through bank transfers. This method is especially reliable for those who prefer using traditional banking channels. To make a deposit, simply initiate a bank transfer from your personal bank account to the account details provided by Pocket Option. The minimum deposit requirement is just $5, making it accessible for traders at all levels.

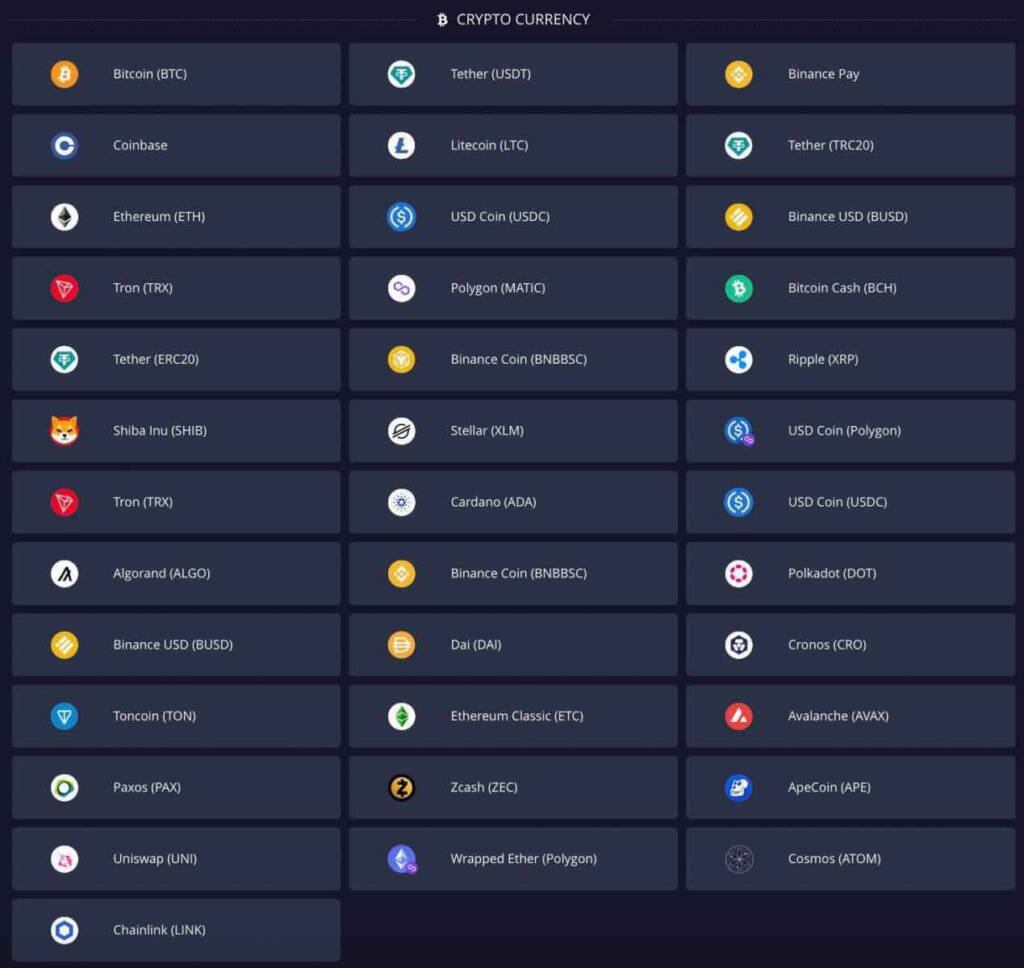

Cryptocurrencies

For traders who prefer digital currencies, Pocket Option supports deposits in popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, USDT, and several others. Depositing via cryptocurrency offers enhanced privacy and operates independently of any central authority or financial intermediary. The minimum deposit amount is $10, making it a flexible and modern payment option for traders worldwide.

How to Deposit Money on Pocket Option

Deposit Money on Pocket Option: A Step-by-Step Guide

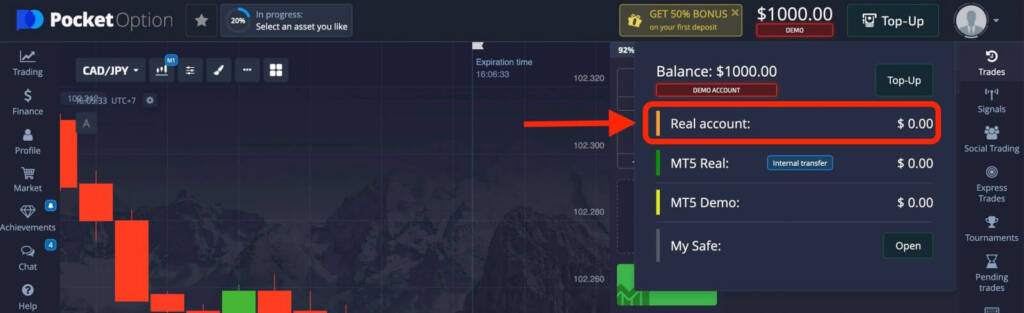

If you want to start trading with real money, you need to make a deposit first. I will show you how to deposit on Pocket Option in a few simple steps.

Step 1: Log in to your Pocket Option account and click on the “Top-Up” button at the top right corner of the screen. If you don’t have one yet, you can sign up for free here.

Step 2: You will see a new window with different payment methods. Choose your preferred payment method. Pocket Option supports various payment methods, such as credit cards, e-wallets, cryptocurrencies, and bank transfers.

Step 3: Enter the amount you want to deposit. You can also choose a gift and bonus offer if you want to get some extra funds for trading.

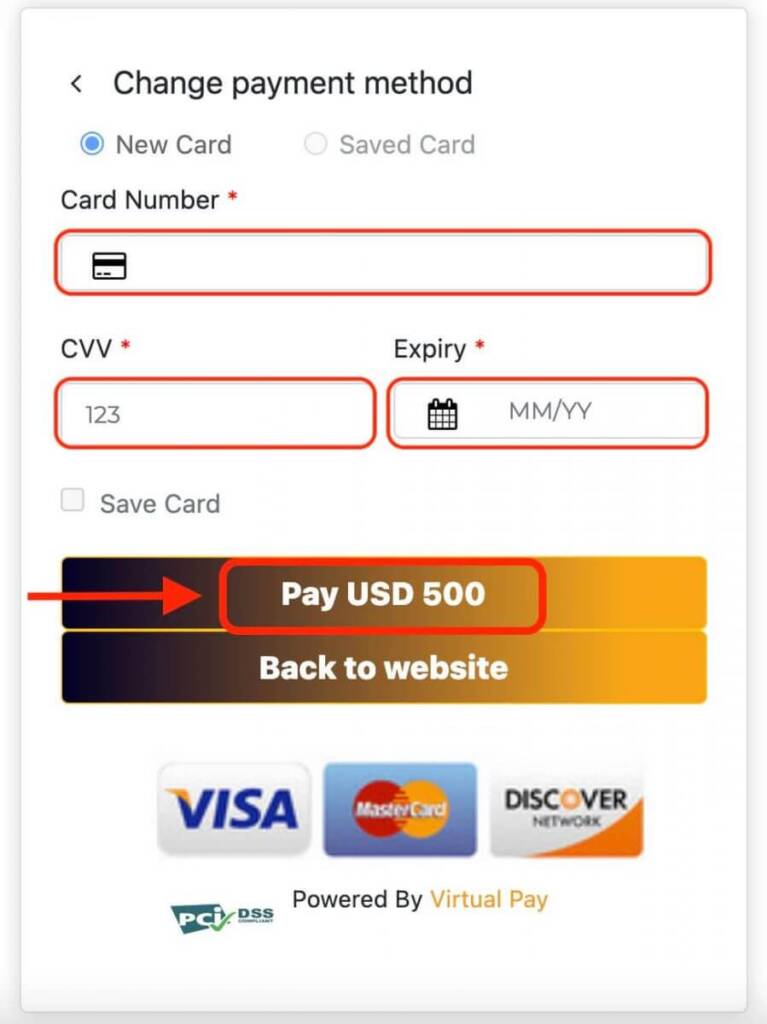

Step 4: You will be redirected to the payment provider’s website, where you will need to complete the transaction.

Step 5: Confirm Your Deposit

Before finalizing your deposit, carefully review all the details you have entered, including the deposit amount and payment information. Once your payment is successfully processed, a confirmation message will appear on your screen, and the funds should reflect in your trading account balance within a few seconds. You can conveniently track your balance and review your transaction history through your account dashboard.

Congratulations! You have successfully deposited funds into your Pocket Option account and are now ready to start trading binary options, forex, cryptocurrencies, and more.

Pocket Option is committed to providing a smooth payment experience. It is important to be aware of factors such as associated fees, minimum deposit amounts, currency conversion rates, and any verification requirements for certain payment methods. Keeping these in mind will help you make informed decisions and manage your finances effectively while trading.

Minimum Deposit for Pocket Option

One of the major advantages of Pocket Option is its low minimum deposit requirement of just $5, which is significantly lower than many other trading platforms that may require hundreds or even thousands of dollars. This makes Pocket Option an ideal choice for beginners and traders with smaller budgets. You can start trading with a small amount, test your strategies, and build confidence without risking too much capital.

Pocket Option Deposit Fees

Pocket Option prides itself on offering deposit options without any platform fees. This applies to most payment methods, including credit/debit cards, e-wallets, cryptocurrencies, and bank transfers.

However, it is important to note that some payment providers or financial institutions may charge their own transaction or currency conversion fees. These fees are determined by the provider, not Pocket Option.

For bank transfers, your personal bank may impose a fee for initiating the transaction. Pocket Option does not charge for bank deposits, but it is advisable to check with your bank regarding any applicable charges.

How Long Does a Pocket Option Deposit Take?

The processing time for deposits depends on the payment method you choose. Here’s a general overview:

-

Credit/Debit Cards: Deposits via credit or debit cards are usually processed instantly, allowing you to start trading immediately.

-

E-Payments (Electronic Payment Systems): Popular systems like Advcash, WebMoney, Perfect Money, and others typically process deposits instantly or within 5 minutes, ensuring fast access to your funds.

-

Cryptocurrencies: Deposit times depend on the blockchain network and the number of confirmations required. Generally, transactions are completed within a few minutes to an hour, depending on the cryptocurrency used.

-

Bank Transfers: Deposits via bank transfer usually take longer, potentially several business days, depending on the banks involved, intermediary processes, and your location.

Benefits of Depositing Funds on Pocket Option

-

No Fees or Commissions: Pocket Option does not charge any fees for depositing funds, allowing you to fund your account without extra costs.

-

Access to Diverse Markets: Depositing funds opens the door to a wide range of financial markets, including currencies, commodities, indices, and cryptocurrencies. A funded account allows you to diversify your portfolio and explore multiple trading opportunities across different asset classes.

-

Real-Time Trading: With funds readily available in your account, you can execute trades immediately, take advantage of market opportunities as they arise, and capitalize on favorable conditions without delay.

-

Leveraged Trading: Deposits enable you to use leverage, which amplifies your potential returns. This allows you to take larger positions than your initial deposit would permit, increasing exposure to profitable trades.

Drawbacks of Bank Transfers for Deposits

While bank transfers are secure and reliable, there are some limitations to consider:

-

Slow Processing Time: Bank transfers can take longer than other payment methods to complete and verify. This may be inconvenient if you want to start trading immediately or need quick access to funds.

-

Limited Availability: Bank transfers may not be supported in certain countries or regions due to legal or regulatory restrictions.

Security Measures for Deposits on Pocket Option

Pocket Option prioritizes the security of users’ funds and personal information. The platform implements several robust security measures to ensure a safe deposit process:

-

SSL Encryption: All data transmitted between traders and Pocket Option is encrypted using industry-standard SSL technology, protecting sensitive information from unauthorized access.

-

Segregated Accounts: Traders’ funds are held in segregated accounts, separate from the company’s operational funds. This ensures deposits remain protected even in unforeseen circumstances.

-

Regulatory Compliance: Pocket Option operates in line with international financial standards and adheres to regulatory guidelines, enhancing transparency and safeguarding users’ funds.

If you want, I can now combine all your deposit-related sections (step-by-step guide, methods, benefits, security, fees, processing times) into one comprehensive, professional, and SEO-friendly guide. This would make it ready for a blog, article, or website post.